kansas automobile sales tax calculator

Vehicle Property Tax Calculator Estimate vehicle property tax by makemodelyear or VIN Vehicle Tags and Titling What you need to know about titling and tagging your vehicle. Sales Tax Table For Butler County Kansas.

You will pay property tax when you initially register a vehicle and each year when you renew your vehicle registration.

. If you have any questions about how Kansas sales and use tax laws apply to your business please visit the departments Policy Information Library on our web site wwwksrevenuegov. Kansas Income Tax Calculator 2021. Kansas collects a 73 to 8775 state sales tax rate on the purchase of all vehicles.

Ad Lookup Sales Tax Rates For Free. The rate ranges from 75 and 106. This includes the rates on the state county city and special levels.

Your average tax rate is 1198 and your marginal tax rate is. Use this online tool from the kansas department of revenue to help calculate the amount of property tax you will owe on your vehicle. The Sales Tax Varies Greatly By.

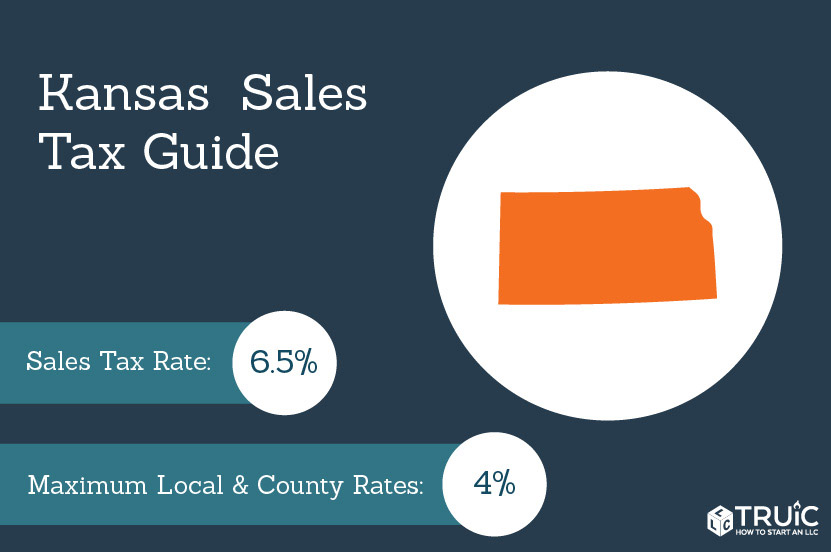

In addition to taxes car. For instance if you purchase a vehicle from a private party for 27000 and you live in a. County and local taxes can accrue an additional maximum of 4 in sales tax.

If you make 70000 a year living in the region of Kansas USA you will be taxed 12078. The sales tax rate on vehicles in Kansas is 73 to 8775 or 75 on average. There are also local taxes up to 1 which will vary depending on region.

Kansas Vehicle Property Tax Check - Estimates Only. The state sales tax applies for private car sales in Kansas. The state sales tax rate in kansas is 650.

How to Calculate Kansas Sales Tax on a Car. Our required dealer documentation fee is 399. The average cumulative sales tax rate in Parsons Kansas is 925.

Kansas Department of Revenues Division of Vehicles launched KnowTo Drive Online a web-based version of its drivers testing exam powered by Intellectual Technology Inc. Parsons is located within Labette County Kansas. Interactive Tax Map Unlimited Use.

Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 663 in Butler County Kansas. The estimated tax and registration combined is 3841 but this may vary based on vehicle type and weight. Use the Kansas Department of Revenue Vehicle Property Tax.

Search for Vehicles by VIN -Or- Make Model Year -Or- RV Empty Weight Year. This calculator can help you estimate the taxes required when purchasing a new or used vehicle. Vehicle Property Tax Estimator Use this online tool from the Kansas Department of Revenue to help calculate the amount of property tax you will owe on your vehicle.

The information you may need to enter into the tax and tag calculators may. The sales tax in. Anytime you are shopping around for a new vehicle and are beginning to make a.

Adjust quote numbers in. Ad Receive Car Selling Tips Pricing Updates New Used Car Reviews More. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Kansas local counties cities and special taxation.

State Corporate Income Tax Rates And Brackets Tax Foundation

Free Business Sales Tax Calculator Calculate Your Tax Now With Clickfunnels

Kansas Sales Tax Small Business Guide Truic

Car Tax By State Usa Manual Car Sales Tax Calculator

Missouri Car Sales Tax Calculator Missouri Country Club Plaza Photography Courses

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

How To Charge Sales Tax In The Us 2022

Taxjar State Sales Tax Calculator Sales Tax Nexus Tax

Trade In Sales Tax Savings Calculator Find The Best Car Price

How To Calculate Sales Tax For Your Online Store

Calculate The Sales Taxes In The Usa For 2022 Credit Finance